Pay Salary Journal Entry . The company has paid a wage to the worker, it needs to record as an expense. the payroll accounting journal entries would be as follows: this article on journal entries for salary payments is a great resource for anyone looking to improve their understanding of. please prepare a journal entry for a paid wage. examples of payroll journal entries for salaries. The gross wage is the expense charged to the income statement. Recording a payroll journal entry can either be done manually or. how to record a payroll journal entry in 5 steps. payroll journal entries are used to record the compensation paid to employees. In the following examples we assume that the employee’s tax rate for.

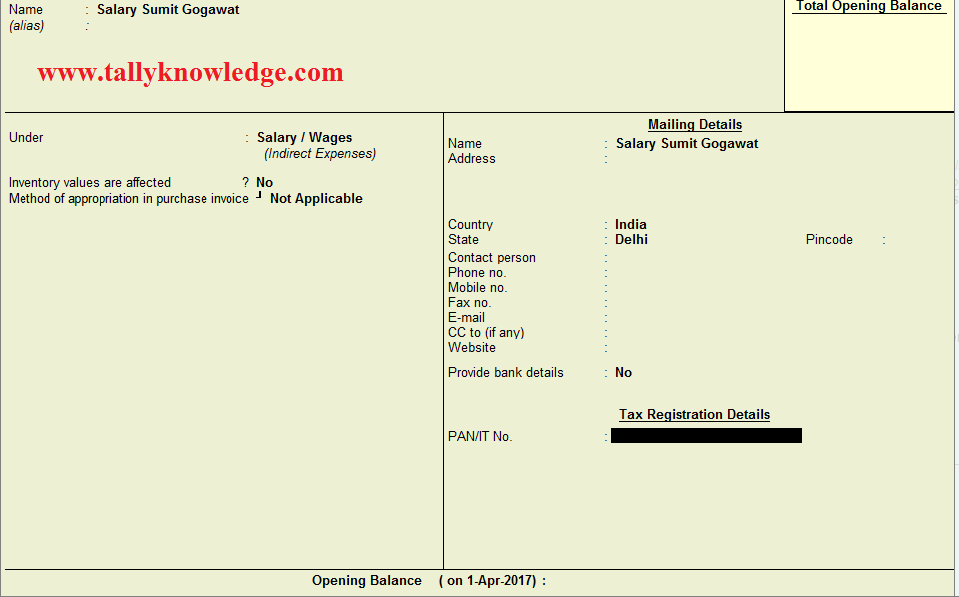

from www.tallyknowledge.com

how to record a payroll journal entry in 5 steps. the payroll accounting journal entries would be as follows: payroll journal entries are used to record the compensation paid to employees. this article on journal entries for salary payments is a great resource for anyone looking to improve their understanding of. The gross wage is the expense charged to the income statement. In the following examples we assume that the employee’s tax rate for. Recording a payroll journal entry can either be done manually or. examples of payroll journal entries for salaries. please prepare a journal entry for a paid wage. The company has paid a wage to the worker, it needs to record as an expense.

How to Pass Salary Payable voucher in Tally.ERP through Journal

Pay Salary Journal Entry payroll journal entries are used to record the compensation paid to employees. the payroll accounting journal entries would be as follows: examples of payroll journal entries for salaries. how to record a payroll journal entry in 5 steps. this article on journal entries for salary payments is a great resource for anyone looking to improve their understanding of. Recording a payroll journal entry can either be done manually or. In the following examples we assume that the employee’s tax rate for. please prepare a journal entry for a paid wage. payroll journal entries are used to record the compensation paid to employees. The company has paid a wage to the worker, it needs to record as an expense. The gross wage is the expense charged to the income statement.

From www.mascolostyles.co.uk

Payroll Accounting — Mascolo & Styles Bookkeeping & Outsourced Pay Salary Journal Entry examples of payroll journal entries for salaries. the payroll accounting journal entries would be as follows: The gross wage is the expense charged to the income statement. In the following examples we assume that the employee’s tax rate for. payroll journal entries are used to record the compensation paid to employees. how to record a payroll. Pay Salary Journal Entry.

From www.pinterest.com

A payroll journal entry is a method of accrual accounting, in which a Pay Salary Journal Entry how to record a payroll journal entry in 5 steps. In the following examples we assume that the employee’s tax rate for. examples of payroll journal entries for salaries. The gross wage is the expense charged to the income statement. this article on journal entries for salary payments is a great resource for anyone looking to improve. Pay Salary Journal Entry.

From www.tallyknowledge.com

How to Pass Salary Payable voucher in Tally.ERP through Journal Pay Salary Journal Entry In the following examples we assume that the employee’s tax rate for. payroll journal entries are used to record the compensation paid to employees. how to record a payroll journal entry in 5 steps. The gross wage is the expense charged to the income statement. The company has paid a wage to the worker, it needs to record. Pay Salary Journal Entry.

From www.j-ethinomics.org

Journal entry for outstanding expenses JEthinomics Pay Salary Journal Entry the payroll accounting journal entries would be as follows: please prepare a journal entry for a paid wage. how to record a payroll journal entry in 5 steps. The gross wage is the expense charged to the income statement. Recording a payroll journal entry can either be done manually or. payroll journal entries are used to. Pay Salary Journal Entry.

From jkbhardwaj.com

Salary paid Journal Entry Class 11 Pay Salary Journal Entry In the following examples we assume that the employee’s tax rate for. examples of payroll journal entries for salaries. payroll journal entries are used to record the compensation paid to employees. The company has paid a wage to the worker, it needs to record as an expense. The gross wage is the expense charged to the income statement.. Pay Salary Journal Entry.

From www.youtube.com

How to Enter Salary and Salary Advance Entries in Tally ERP9 YouTube Pay Salary Journal Entry In the following examples we assume that the employee’s tax rate for. The company has paid a wage to the worker, it needs to record as an expense. The gross wage is the expense charged to the income statement. how to record a payroll journal entry in 5 steps. the payroll accounting journal entries would be as follows:. Pay Salary Journal Entry.

From studymagicbuckley.z19.web.core.windows.net

Salaries And Wages Account Is Shown In Pay Salary Journal Entry In the following examples we assume that the employee’s tax rate for. Recording a payroll journal entry can either be done manually or. payroll journal entries are used to record the compensation paid to employees. the payroll accounting journal entries would be as follows: please prepare a journal entry for a paid wage. The company has paid. Pay Salary Journal Entry.

From alvysalary.blogspot.com

Gross Pay Journal Entry Alvy Salary Pay Salary Journal Entry The company has paid a wage to the worker, it needs to record as an expense. examples of payroll journal entries for salaries. In the following examples we assume that the employee’s tax rate for. how to record a payroll journal entry in 5 steps. The gross wage is the expense charged to the income statement. Recording a. Pay Salary Journal Entry.

From www.carunway.com

TDS on Salary Journal Entry CArunway Pay Salary Journal Entry please prepare a journal entry for a paid wage. The gross wage is the expense charged to the income statement. examples of payroll journal entries for salaries. the payroll accounting journal entries would be as follows: The company has paid a wage to the worker, it needs to record as an expense. how to record a. Pay Salary Journal Entry.

From www.chegg.com

Solved All of the journal entries are correct. However, for Pay Salary Journal Entry The gross wage is the expense charged to the income statement. Recording a payroll journal entry can either be done manually or. examples of payroll journal entries for salaries. The company has paid a wage to the worker, it needs to record as an expense. In the following examples we assume that the employee’s tax rate for. this. Pay Salary Journal Entry.

From blog.siliconbullet.com

How To Correctly Post Your Salary Journal Pay Salary Journal Entry payroll journal entries are used to record the compensation paid to employees. The company has paid a wage to the worker, it needs to record as an expense. The gross wage is the expense charged to the income statement. how to record a payroll journal entry in 5 steps. the payroll accounting journal entries would be as. Pay Salary Journal Entry.

From itassolutions.co.uk

Sage 50 Payroll Key Features Pay Salary Journal Entry examples of payroll journal entries for salaries. this article on journal entries for salary payments is a great resource for anyone looking to improve their understanding of. how to record a payroll journal entry in 5 steps. please prepare a journal entry for a paid wage. payroll journal entries are used to record the compensation. Pay Salary Journal Entry.

From mypaysolutions.thomsonreuters.com

Payroll reports myPay Solutions Thomson Reuters Pay Salary Journal Entry the payroll accounting journal entries would be as follows: In the following examples we assume that the employee’s tax rate for. this article on journal entries for salary payments is a great resource for anyone looking to improve their understanding of. Recording a payroll journal entry can either be done manually or. examples of payroll journal entries. Pay Salary Journal Entry.

From salarymania.blogspot.com

Salary Journal Entry Malaysia Salary Mania Pay Salary Journal Entry Recording a payroll journal entry can either be done manually or. please prepare a journal entry for a paid wage. payroll journal entries are used to record the compensation paid to employees. examples of payroll journal entries for salaries. In the following examples we assume that the employee’s tax rate for. The gross wage is the expense. Pay Salary Journal Entry.

From spscc.pressbooks.pub

LO 3.5 Use Journal Entries to Record Transactions and Post to T Pay Salary Journal Entry examples of payroll journal entries for salaries. please prepare a journal entry for a paid wage. The company has paid a wage to the worker, it needs to record as an expense. how to record a payroll journal entry in 5 steps. the payroll accounting journal entries would be as follows: In the following examples we. Pay Salary Journal Entry.

From cagamee.com

How To Journalize Salaries Cagamee Pay Salary Journal Entry examples of payroll journal entries for salaries. The company has paid a wage to the worker, it needs to record as an expense. The gross wage is the expense charged to the income statement. Recording a payroll journal entry can either be done manually or. In the following examples we assume that the employee’s tax rate for. how. Pay Salary Journal Entry.

From www.youtube.com

Payroll Expense Journal EntryHow to record payroll expense and Pay Salary Journal Entry payroll journal entries are used to record the compensation paid to employees. the payroll accounting journal entries would be as follows: Recording a payroll journal entry can either be done manually or. how to record a payroll journal entry in 5 steps. examples of payroll journal entries for salaries. please prepare a journal entry for. Pay Salary Journal Entry.

From www.youtube.com

Payroll journal entries Salary provision entry Salary advance entry Pay Salary Journal Entry this article on journal entries for salary payments is a great resource for anyone looking to improve their understanding of. the payroll accounting journal entries would be as follows: how to record a payroll journal entry in 5 steps. The gross wage is the expense charged to the income statement. Recording a payroll journal entry can either. Pay Salary Journal Entry.